Garden State emerges as one of the nation’s strongest housing markets while much of the country slows to post-recession pace

New Jersey’s housing market closed out 2025 on a sharply different trajectory than the rest of the country, posting one of the strongest annual home price gains in the nation even as national growth fell to its slowest pace since the recovery from the Great Recession.

New data released this week shows that U.S. home price growth in December cooled to just 0.9 percent year over year, signaling a broad national reset after years of intense pandemic-era acceleration. Analysts describe the current environment as a rebalancing phase, where affordability, job stability and long-term demand fundamentals are now playing a larger role than rapid speculative price escalation.

Against that backdrop, New Jersey stood out.

The state recorded a 5.5 percent annual increase in home prices, placing it among the top-performing housing markets in the country and firmly bucking the national cooling trend. New Jersey also ranked among a small group of states that reached new highs in annual home price growth by the end of December, underscoring how resilient demand remains across many of the state’s residential submarkets.

The strength in New Jersey is being driven by a combination of structural and demographic forces that continue to favor the state over many traditionally high-growth regions. Compared with coastal Sun Belt and Mountain West markets that surged earlier in the decade, much of New Jersey remains relatively affordable for high-income professionals who are now less tethered to daily office commutes. Hybrid and flexible work patterns have widened the geographic footprint of buyer demand, allowing households to prioritize school districts, transportation access and long-term community stability rather than proximity to a single employment hub.

Regional analysts point to northern and central New Jersey communities, particularly those with direct rail access to Manhattan and growing mixed-use downtowns, as consistent demand drivers. The Newark metro area, in particular, continues to post gains that run counter to the broader national slowdown, reflecting a tight supply environment and sustained interest from first-time buyers, move-up households and investors seeking long-term rental stability.

New Jersey is not alone in its outperformance, but it remains one of the most prominent examples in the Northeast. Other strong states in the latest data include Illinois at 5.4 percent, Nebraska at 5.4 percent and Connecticut at 5.1 percent. Markets such as Newark, Allentown, Pennsylvania and Chicago were highlighted nationally as local standouts in a market otherwise defined by decelerating growth.

New Jersey was one of seven states nationwide to set new highs in annual home price growth as of December. The other states joining that list were Pennsylvania, Delaware, Nebraska, Louisiana, Indiana and Mississippi.

Economists say the divergence between regions reflects a fundamental shift in buyer behavior. High-growth markets in the South and West that previously experienced intense in-migration and investor activity are now absorbing higher inventory levels and cooling demand. At the same time, Northeast and Midwest markets with deeper job bases, mature infrastructure and tighter development pipelines are benefiting from more stable absorption.

Industry observers note that the national slowdown does not signal a collapse in values, but rather a recalibration after years of unsustainable price acceleration.

While upward pressure remains in many markets, the pace has moderated enough to suggest that buyers may encounter a more navigable landscape in 2026—particularly in regions where new listings are beginning to rebuild and sellers are adjusting expectations.

In sharp contrast to New Jersey’s continued momentum, negative home price growth is now concentrated across large portions of the South and West. States and regions including Florida, Texas, Colorado, Washington, D.C., Hawaii, Arizona, Utah, Oregon and California are showing outright price declines or stagnation. Analysts attribute the downturn in those markets to a surge in resale and new-construction inventory, higher mortgage rates relative to local incomes and a slowdown in population inflows that once fueled rapid appreciation.

New Jersey’s housing dynamics remain constrained by limited developable land, a lengthy approval process for large-scale residential projects and persistent under-supply in both entry-level and mid-priced housing. Those structural supply limitations continue to place upward pressure on values, even as national demand softens.

At the same time, the state’s diversified economy—anchored by healthcare, life sciences, finance, logistics, technology and higher education—has provided an unusually stable employment base for homeowners. That economic diversity has reduced the risk of sharp localized downturns and continues to support household formation across multiple income brackets.

Local brokers and developers also point to sustained interest in transit-oriented development, adaptive reuse projects and suburban infill communities as important contributors to price stability. Buyers are showing growing interest in properties that offer walkable amenities, access to commuter rail and flexible living space that accommodates remote and hybrid work arrangements.

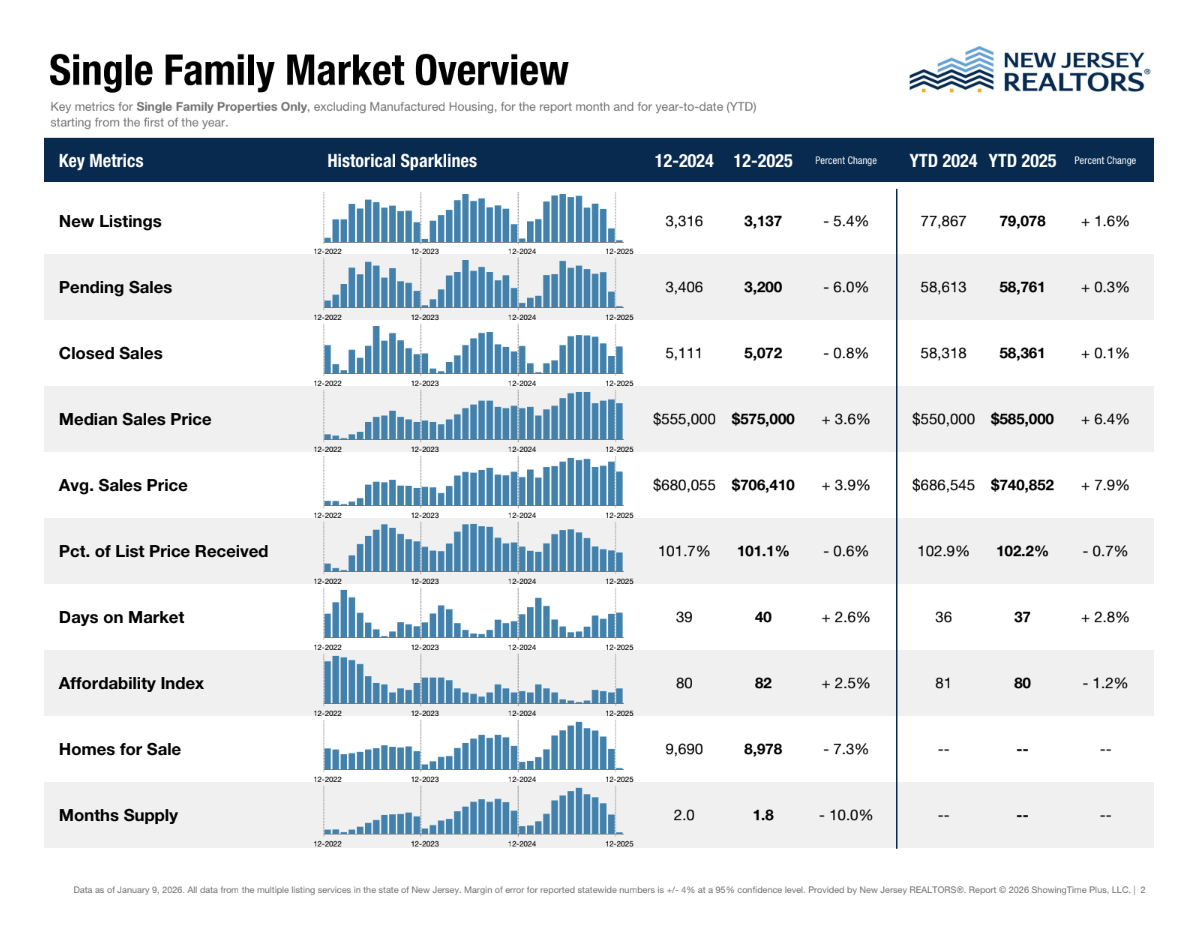

Looking ahead to early 2026, housing economists expect New Jersey’s market to remain competitive but less frenzied than in recent years. Multiple-offer situations are becoming less common in certain submarkets, and days on market are gradually lengthening, but overall supply remains tight enough to prevent meaningful downward pressure on prices.

For buyers and sellers alike, the state’s performance highlights how regional housing conditions now diverge far more sharply than national averages suggest. While the U.S. market enters a slower and more balanced phase, New Jersey continues to operate in a fundamentally different demand environment—one shaped by constrained supply, resilient employment and enduring commuter-driven location advantages.

Ongoing coverage of housing conditions, development trends and transaction activity across New Jersey is available through Sunset Daily News’ in-depth real estate reporting.