トムウッド スクエアシルバーリング サイズ58

(税込) 送料込み

商品の説明

材質···シルバー

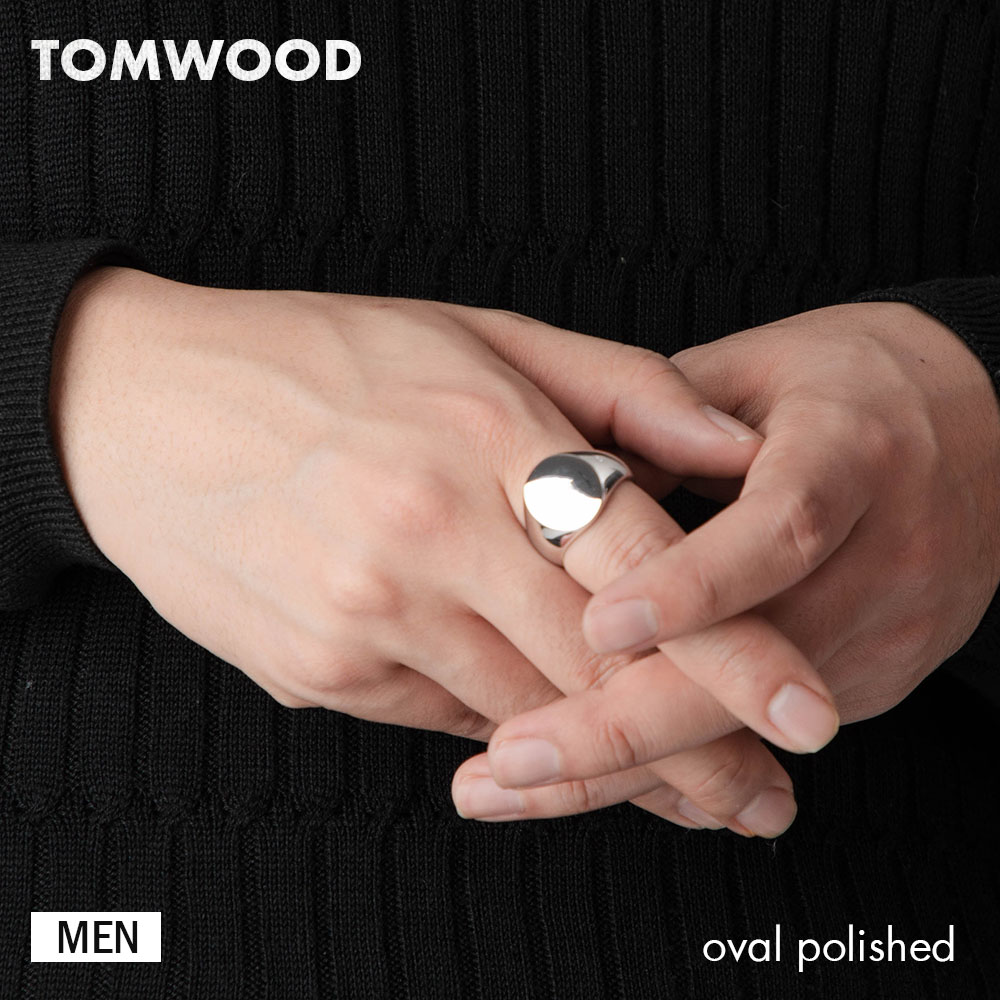

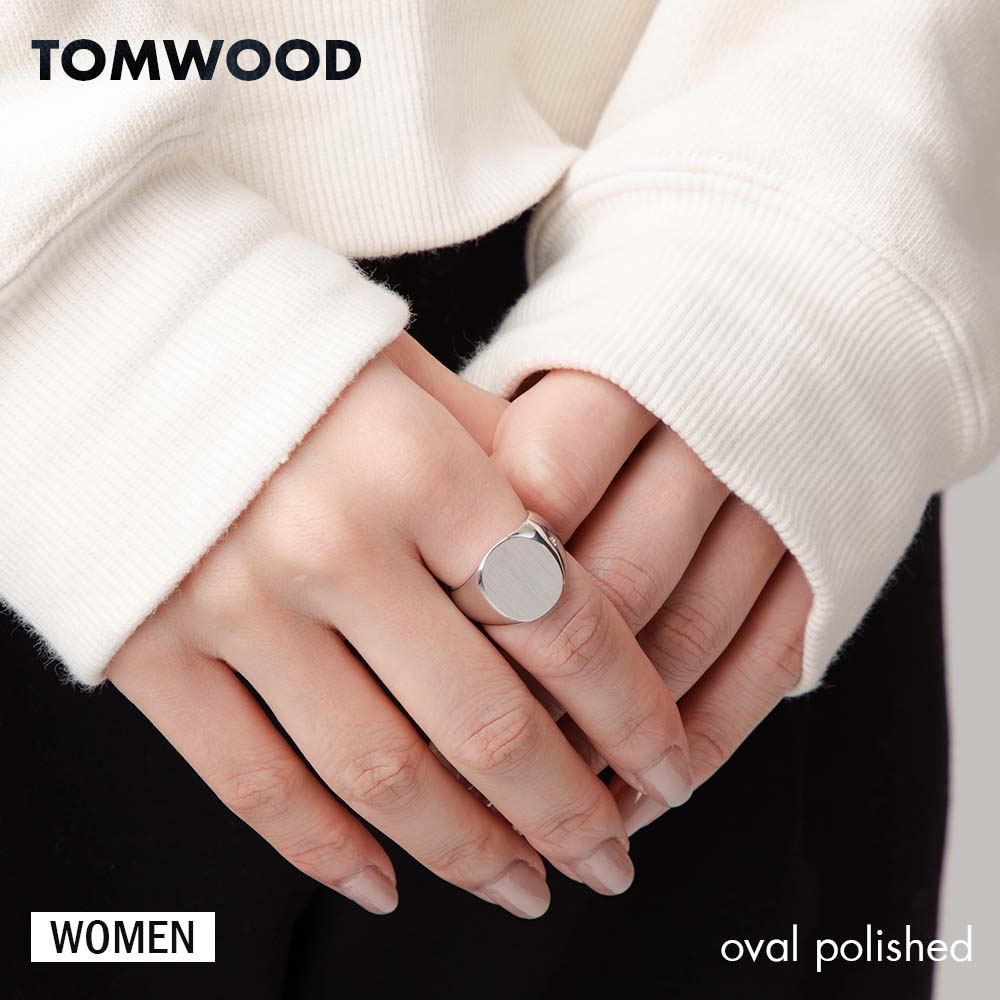

トムウッド のシルバーリング

サイズ58

日本で18号くらいです。

箱あります!

小傷や汚れ少しありますが、

気になるほどではありません!

シンプルでおしゃれです。商品の情報

| カテゴリー | ファッション > メンズ > アクセサリー |

|---|---|

| ブランド | トムウッド |

| 商品の状態 | やや傷や汚れあり |

トムウッド スクエアシルバーリング サイズ58-

トムウッド スクエアシルバーリング サイズ58-

トムウッド TOM WOOD シルバーリング 58号-

tomwood スクエア リング | hartwellspremium.com

トムウッド TOM WOOD シルバーリング 58号-

新作商品 トムウッド スクエアシルバーリング サイズ58 リング

ギフ_包装】 トムウッド スクエアシルバーリング サイズ58 リング

TOMWOOD CushionOpen Ring サイズ58 代引可 メンズ - 通販

TOMWOOD トムウッド シルバー スクエアリング Clean Cushion

58 新品 トムウッド TOM WOOD クッション レオパード リング スクエア

58 新品 トムウッド TOM WOOD クッション レオパード リング スクエア

TOM WOOD リング

TOMWOOD トムウッド シルバー スクエアリング Clean Cushion

楽天市場】TOMWOOD トムウッド リング 指輪 9K ゴールド シルバー

58 新品 トムウッド TOM WOOD クッション レオパード リング スクエア

58 新品 トムウッド TOM WOOD クッション レオパード リング スクエア

ギフ_包装】 トムウッド スクエアシルバーリング サイズ58 リング

2023特集 新品 クッション Amazon TOM WOOD トムウッド スクエア

58 新品 トムウッド TOM WOOD クッション レオパード リング スクエア

楽天市場】トムウッド TOM WOOD 100368M R74HRNA01 S925 リング メンズ

58 新品 トムウッド TOM WOOD クッション レオパード リング スクエア

2024年最新】tomwood リング 58の人気アイテム - メルカリ

TOM WOOD トムウッド オニキスリング 58号 常田大希-

トムウッド TOM WOOD シルバーリング 58号-

TOM WOOD トムウッド オニキスリング 58号 常田大希-

【楽天市場】トムウッド TOM WOOD R74IDNA01 S925 リング

トムウッド シルバーリング-

トムウッド TOM WOOD シルバーリング 58号-

TOMWOOD トムウッド リング 指輪 シルバー Wavy Square TOMWOOD

トムウッド TOM WOOD シルバーリング 58号-

楽天市場】TOMWOOD トムウッド シルバー スクエアリング Clean Cushion

トムウッド シルバーリング-

TOMWOOD トムウッド シルバー スクエアリング Clean Cushion TOMWOOD

トムウッド TOM WOOD シルバーリング 58号-

楽天市場】トムウッド TOM WOOD R74HVNA02 S925 リング 指輪

トムウッド シルバーリング-

2024年最新】tomwood リング 58の人気アイテム - メルカリ

TOM WOOD - 新品 トムウッド TOMWOOD リング RING シルバーの通販 by

![Amazon | [トムウッド] リング メンズ レディース CUSHION OPEN RING](https://m.media-amazon.com/images/I/61uUemzGiwL._AC_UY580_.jpg)

Amazon | [トムウッド] リング メンズ レディース CUSHION OPEN RING

TOM WOOD トムウッド オニキスリング 58号 常田大希-

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています